9 chime® spotme questions (quick answers!)

Have you ever been in a situation where you need to set up Chime® SpotMe but don’t know what questions you should be asking?

Chime® SpotMe is one of the most valuable tools offered by many financial institutions. This payment technology lets customers transfer funds over the phone and also allows cardholders to make purchases with certain financial partners without having to go through other channels. It provides a great service for those who may not have access to traditional banking services, as well as for recurring payments.

Everyone should take advantage of this service if possible, but the process can sometimes feel complicated and confusing. That’s why it’s important to ask the right questions when setting up Chime® SpotMe. To make sure that your account is functioning correctly and you get access to all its features, here are nine of the most common questions that you should be asking about Chime® SpotMe.

How does Chime SpotMe work?

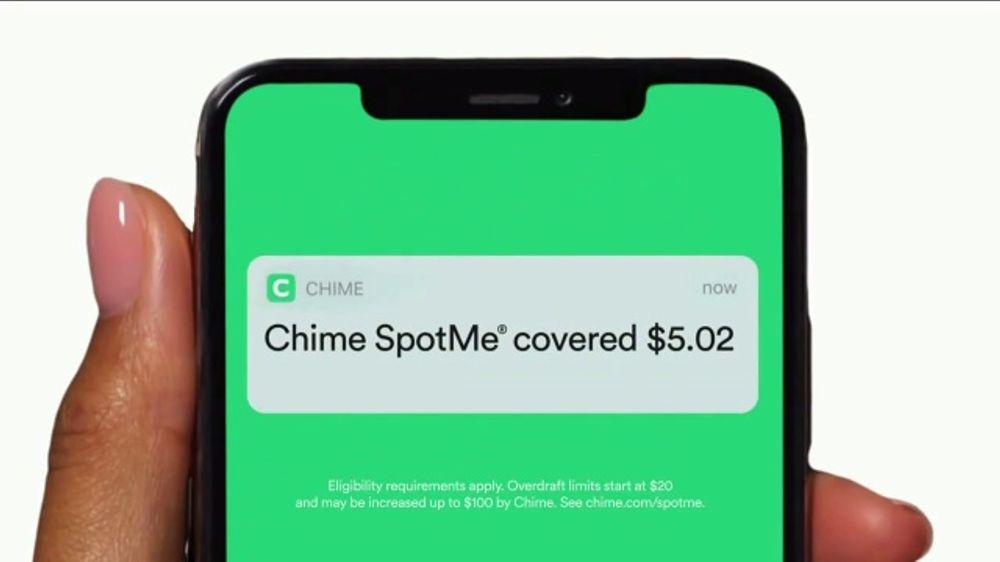

Chime SpotMe is an innovative service offered by the online bank Chime that helps its customers eliminate overdraft fees associated with traditional banking. With Chime SpotMe, customers can get up to $200 in overdraft coverage if they have enrolled and use their debit card for purchases that exceed the amount of money in their account. This is incredibly helpful for those who need to make a purchase when their funds are low or temporarily unavailable, as it eliminates the costly fees associated with traditional overdrafts.

In order to register for Chime SpotMe, customers will need to log into their Chime banking app and select “Enable SpotMe” from the Settings tab. They will then be reviewed and approved (or rejected) within a few minutes. If approved, they will immediately be given access to Chime SpotMe and provided with a limit of up to $20 which can be increased over time as long as users continue to demonstrate responsible spending habits while making payments on time. When users spend more than what is available in their account, Chime will cover that difference automatically up to their set limit, removing the potential burden of added financial hardship and sparing them from unwanted fees not experienced with most other banks.

Who is eligible for Chime SpotMe?

Chime SpotMe is a great new feature that helps its members bridge the gap when life happens and you unexpectedly run out of funds before payday. To take advantage of this service, you must have a qualifying direct deposit of at least $200 into your Spending Account with Chime. Qualifying direct deposits can come from an employer, payroll provider, gig economy payer, or government benefit payer.

The beauty of Chime’s SpotMe service is that it allows you to cover those times when you don’t quite have enough in the bank to cover unexpected expenses. With SpotMe there’s no need for costly overdraft fees, just a quick transfer directly from your Spending Account with Chime and any charges are taken care of automatically on your next monthly payment due date. It’s an easy way to manage financial concerns and get back on track!

How can I get Chime SpotMe?

Chime’s SpotMe program offers users an easy and affordable way to manage their cash flow. It essentially acts like an overdraft line of credit, allowing you to make purchases even when you don’t have enough money in your account. Signing up for Chime SpotMe is a simple and hassle-free process. All you need to do is log into your Chime app and look for the message at the top inviting you to enroll in this service. If you’ve had a qualifying deposit within the last month, then proceed by clicking on the “Set Up SpotMe” button provided. After that, you’ll simply have to enter some basic information about yourself before getting approved in no time at all. With Chime Spotme, all your payments and purchases will be covered with zero fees attached, so no more worrying about costly overdraft charges! This revolutionary product is designed specifically to lend financial support and ensure that short-term cash flow issues don’t derail your goals of lasting financial security.

Can I overdraft Chime without SpotMe?

The Chime banking app provides several features that make it attractive to customers, such as no monthly fees, cash back rewards, and a savings account with a high interest rate. However, overdrawing your account without using Chime SpotMe is not one of them. Chime SpotMe is a feature which allows you to access funds in your checking account even if you don’t have enough money in your balance at the moment. This service is available for qualifying customers after they pass their review process and other necessary requirements. Unlike traditional banks where customers may be able to go above their balance limit if they are in good standing with their relationship bankers, this option will not be available when dealing with Chime.

In short, customers of Chime cannot overdraft their account without signing up for the Chime SpotMe feature first. If you attempt to spend or withdraw more than what is currently available on the customer’s balance, then the transaction will likely be declined unless they have enrolled in the optional overdraft protection program offered by the financial institution. Some people may find this an inconvenience since it requires some extra steps before being able to exceed what’s currently available on the customer’s balance sheet. However, for those who are looking to avoid overdraft fees and maintain their financial health, this could be a great solution.

Where does Chime SpotMe work?

Chime SpotMe offers an innovative banking experience, allowing you to overdraw your account up to a specified limit. This is designed to give you some additional financial flexibility during unexpected situations. To maximize the potential of this service, it is important to understand where Chime SpotMe works and how it can be put into practice.

Chime SpotMe allows you to use the overdraft feature at many retailers and stores with point-of-sale systems, including major merchants such as Walmart, Amazon, and Costco. Additionally, Chime SpotMe works for online purchases from online vendors, including most mainstream e-commerce stores. The service also works within the Chime app itself and may enable some direct transfer payments as well. What’s more, all ATM withdrawals are processed without any fees as long as you remain within your established limit set by Chime. Furthermore, in select states check deposits made may be able to benefit from the service regardless of their respective limits or restrictions imposed by individual banks or credit unions.. In summary, understanding exactly where Chime SpotMe works is crucial if you wish to take full advantage of its features and make the most out of your banking experience!

Does Chime SpotMe work at a gas station?

Using Chime SpotMe at a gas station is possible, but you will have limitations. The Chime SpotMe debit card has limited funds and that amount is meant for everyday purchases. While it can be used to pay for goods or items inside the gas station, it cannot be used to purchase fuel directly from the pump.

When a customer decides to use their Chime SpotMe debit card at a gas station, they must go inside first in order to make the payment. In this particular case, they would have to be present during the transaction and give their card to an assistant so they can charge it with the amount of fuel desired, along with any other items purchased inside the establishment. For customers who value convenience and wish to save time while pumping their fuel, this may be quite inconvenient since they have to walk away from their car in order to pay first before filling up on fuel.

Does Chime SpotMe work with Apple Pay?

Chime SpotMe is a great feature for those who need just a bit of extra cash to cover unexpected expenses or who don’t want to worry about running out of funds in their Chime account. The good news is that this feature works seamlessly with Apple Pay, allowing you to make purchases without having to worry about managing your bank accounts or overdrawing from your account. With Chime SpotMe, the purchase will be approved if there are insufficient funds in your account and the money will be taken out at the end of your billing cycle; this way, you never have to deal with overspending.

Using Chime SpotMe with Apple Pay is simple and straightforward; you’ll select Apple Pay as your payment option, just like any other purchase you would make through the service. The amount needed to cover the purchase will then either come from available funds in your Chime account or, if there aren’t enough funds present, it will utilize Chime SpotMe to pay for the expense up until $100. Afterward, you can quickly repay the balance by transferring the money into your Chime account by when the time comes due. As always, do keep in mind that with services such as these, it’s important to be mindful of how much you are spending and repay your balance as soon as possible.