11 chime overdraft questions (quick answers!)

Have you ever found yourself in an unexpected situation where you’ve overdrawn your account and are now facing hefty fees? Overdraft fees can add up quickly, leaving many people in a financial bind. If you’re unsure about overdraft policies, you’re not alone. It can be difficult to navigate the complex rules and regulations of banks and credit unions.

According to the Consumer Financial Protection Bureau, banks and credit unions made over $11 billion in overdraft fees in 2019. With so much money at stake, it’s important to understand the ins and outs of overdraft fees and policies.

To help you navigate the murky waters of overdraft fees and policies, we’ve put together a list of 11 common questions and quick answers. From “What is an overdraft fee?” to “Can I opt-out of overdraft protection?” we’ve got you covered with straightforward and concise answers. Keep reading to avoid being caught off guard the next time an unexpected withdrawal puts you in the red.

What is Chime?

Chime is a mobile banking platform that allows users to access their money quickly and conveniently. With Chime, users can get paid up to two days early with direct deposit, manage their spending with no overdraft fees or minimum balance requirements, and send cash instantly to family and friends. The app also features budgeting tools and daily balance notifications to help users stay informed about their finances. With its easy-to-use interface, free ATM network, and rewards program, Chime makes managing your money easier than ever.

Overview of Overdraft Questions

Overdraft questions are something that many people have when it comes to their finances. Understanding the different aspects of overdrafts can help you make the best decisions for your financial situation. Here are 11 quick answers to some of the most common overdraft questions:

1. What is an overdraft? An overdraft occurs when you withdraw more money than is available in your account, resulting in a negative balance.

2. What fees are associated with an overdraft? Most banks and credit unions will charge a fee, usually around $35, when they approve an overdraft transaction.

3. Is there a limit to how much I can overdraw? Yes, banks and credit unions typically limit the amount of money you can withdraw before incurring additional fees or penalties.

4. How long do I have to pay back an overdraft? Generally, banks and credit unions will require repayment within 30 days from the date of the transaction.

5. Can I be charged interest on my overdraft? Yes, some banks and credit unions may charge interest on any outstanding balance after a specific period of time.

6. How can I avoid paying overdraft fees? You can avoid paying these fees by setting up notifications for low balances or opting in for automatic transfers from a linked account when your balance is low.

7. Are there other options if my bank charges high fees for overdrafts? Many financial institutions offer alternative accounts with no-fee or lower-cost options such as Chime Bank which offers free ATM withdrawals and no minimum balance requirements or hidden fees.

8. Can my bank deny an overdraft request even if I am eligible? Yes, banks may deny an overdraft

What is an Overdraft Fee?

An overdraft fee is a fee that a bank or financial institution charges when you withdraw more money from your account than you have available. It usually occurs when customers make a purchase, write a check, or use an ATM for more money than is in their account.

The fee can range from $10 to $35 depending on the bank and the individual’s account type. Overdraft fees are typically charged when customers do not have enough funds in their accounts to cover their transaction. This can be avoided by setting up notifications for low balances and opting for automatic transfers from linked accounts, such as those offered by Chime Bank, which offers free ATM withdrawals with no minimum balance requirements or hidden fees. Additionally, it’s important to keep track of your spending habits and make sure you don’t overspend beyond what’s available in your account.

How Does Chime Handle Overdrafts?

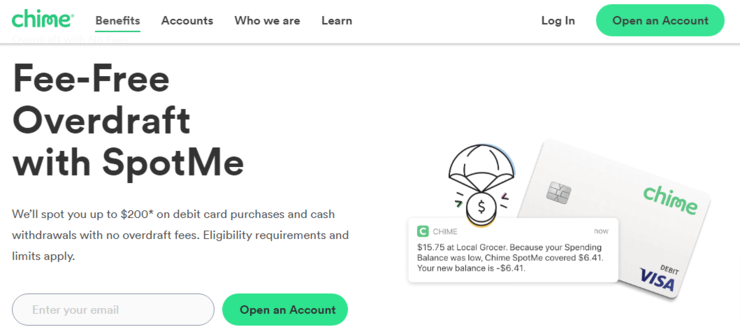

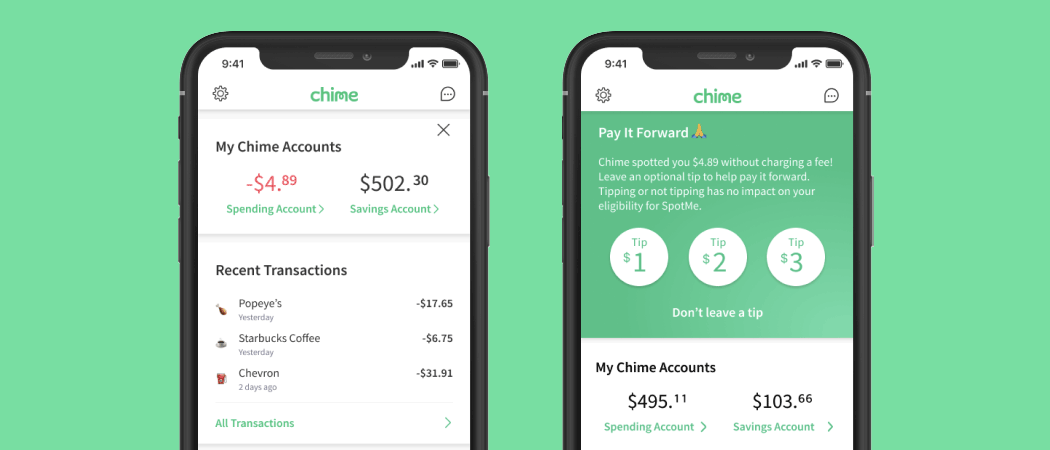

Chime Bank provides a unique way of handling overdrafts. Instead of charging hefty fees for overdrawing, Chime offers a feature called SpotMe which allows customers to go up to $20 over their balance and still pay no fee. To be eligible for the SpotMe feature, customers must have direct deposits of at least $500 within the last month and keep their account in good standing.

Additionally, customers can opt-in to push notifications when their account is running low on funds or if they exceed their available balance. This helps ensure that customers are aware of their spending habits and can avoid any accidental overdrafts. With this feature, Chime has become one of the most flexible banks on the market, providing an easy and convenient way to manage your finances without having to worry about costly overdraft fees.

Can I Opt Out of Overdraft Protection?

Yes, it is possible to opt out of overdraft protection. This can be done by contacting your bank directly or through their online banking service. Opting out of overdraft protection means that if you spend more money than you have in your account, the transaction will simply be declined and no fee will be charged.

This can help save customers from costly overdraft fees, as well as help them keep better track of their spending habits and budgeting goals. However, opting out of overdraft protection also means that if you accidentally spend more money than you have in your account, the transaction will not go through and the purchase may not be able to be completed. It is important to consider this when deciding whether or not to opt out of overdraft protection.

Does Chime Charge an NSF Fee?

Chime does not charge an NSF (Non-Sufficient Funds) fee if a transaction is declined due to insufficient funds. When customers make a purchase with Chime, the bank temporarily holds the amount of the purchase in their account until it is authorized by the merchant. If the transaction is declined due to insufficient funds, then no fee will be charged and no overdraft protection will be triggered.

This helps customers avoid costly fees and allows them to keep better track of their spending habits. In addition, Chime also offers its customers multiple ways to stay informed about their balance, including text message alerts and mobile banking apps. By staying informed about their account balances, customers can help ensure that they don’t accidentally spend more money than they have in their accounts and avoid any unnecessary charges or fees.

How Do I Know if I’ve Been Charged an Overdraft Fee?

Overdraft fees can be an unexpected and unwelcome surprise. Fortunately, Chime makes it easy to keep track of your transactions and avoid overdraft fees. First, customers can log in to their Chime account on the app or website to review their recent transactions and check their available balance.

Additionally, customers can easily set up balance alerts with Chime which will send notifications via text message or email whenever their balances reach certain levels. If any charges appear on a customer’s statement that they don’t recognize as being from a legitimate purchase or payment then they may have been charged an overdraft fee.

Finally, customers should always check the “Fees & Charges” section of their monthly statement for details about any fees that were charged during the period covered by the statement. By taking these steps, customers can easily stay informed and prevent unwanted overdraft fees from appearing on their statements.

Does Chime Send Notifications for Authorization Holds or Pending Transactions That Could Result in an Overdraft Fee?

Chime customers can easily stay on top of their account balances and avoid unexpected overdraft fees by setting up balance alerts. When a customer sets up an alert, they will receive notifications via text message or email whenever their balance reaches a certain level.

Additionally, Chime also sends notifications for authorization holds and pending transactions that could result in an overdraft fee if the transaction is not completed before additional funds are deposited. This helps customers keep track of their spending and prevent overdraft fees from occurring. By taking advantage of these features, Chime customers can easily remain aware of their financial situation and take proactive steps to avoid overdraft fees.

How Much Does Chime Charge for an Overdraft Fee?

Chime charges a $25 fee for overdrafts. This fee is applied when a customer’s account balance goes below zero and is immediately deducted from their account. Overdraft fees can be avoided by keeping track of spending, setting up balance alerts, and making sure that sufficient funds are in the account to cover all transactions.

Additionally, Chime also offers its customers the option of linking an external bank account as an overdraft protection service. This allows customers to transfer funds from their external account into their Chime Spending Account if necessary, so they won’t incur any overdraft fees. Customers should keep in mind that there may be fees associated with transferring money between bank accounts, so it’s important to review all terms and conditions before signing up for this service.

Is There a Way to Waive or Refund an Overdraft Fee from My Account Balance?

Yes, it is possible to waive or refund an overdraft fee from your account balance. If you believe the overdraft fee was charged in error, you can contact Chime customer service for assistance. The customer service team may be able to review the transaction and determine if a refund is warranted. If a refund is approved, the funds will be credited back to your account within one to two business days.

Additionally, customers may also be able to set up an overdraft protection plan which would allow them to transfer funds from an external bank account into their Chime Spending Account in order to avoid any overdraft fees. This can be a great way for customers to ensure that they are always covered and don’t have any surprise fees added onto their accounts.

Conclusion

It is important to carefully consider all of your options when faced with an unavoidable overspend. While paying out of pocket may be the most straightforward solution, there are other alternatives available such as an automatic transfer from a Chime account, overdraft protection plans from many banks, and using a line of credit or loan. By taking the time to explore each option thoroughly and understanding the associated terms, you can find the best solution for your individual needs and get back on track financially.