13 venmo deposit questions (answered & explained!)

Venmo has become a popular method for money transfers in recent years, but with its convenience comes a lot of questions. Have you ever wondered how to deposit money into your Venmo account or what the transaction limits are? If so, you’re not alone.

Venmo is a mobile payment service that allows users to transfer money to each other. It has exploded in popularity and has become an essential tool for many people. However, with so many features, it’s easy to get lost in the details.

If you’re new to Venmo or simply have some questions about deposits, you’ve come to the right place. In this article, we’ll provide answers to 13 of the most frequently asked questions about Venmo deposits. So, whether you’re a seasoned Venmo user or just getting started, keep reading to learn all you need to know about deposits on the platform.

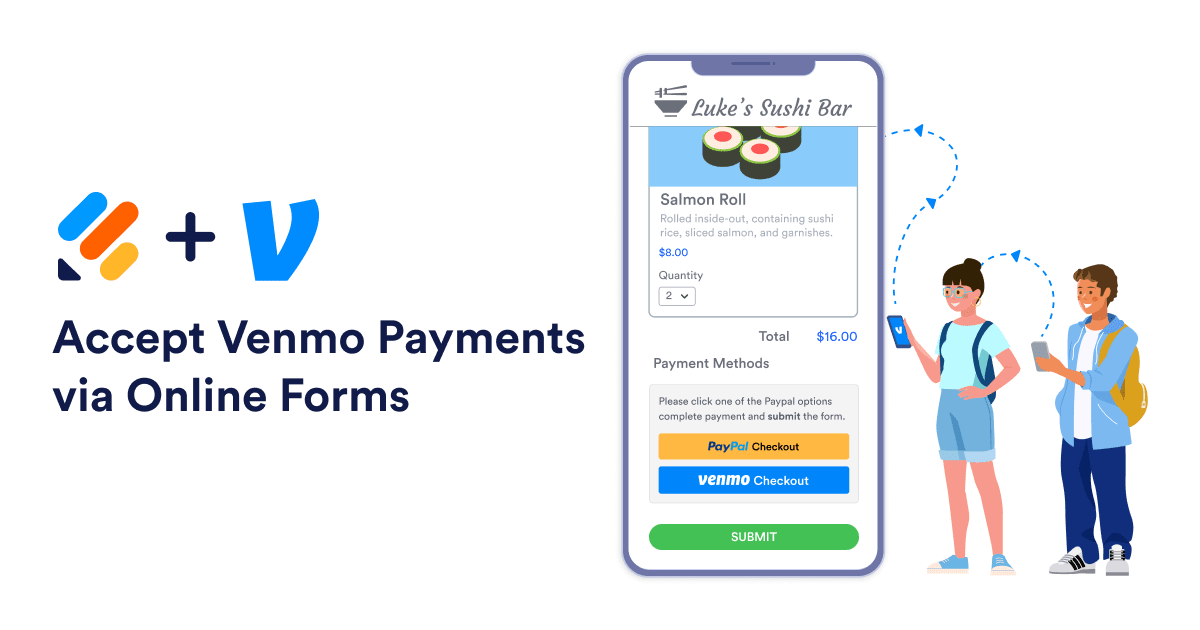

What is Venmo?

Venmo is an online money transfer service owned by PayPal. It allows users to send and receive payments from friends and family, as well as make purchases from select merchants. All transactions are made through the app or website, with no physical cash exchanged.

Users can also add their debit card or bank account information for quick transfers and deposits. Venmo is free to use for person-to-person transactions, but there may be fees associated with some merchant services. With its convenient payment methods and social media integration, Venmo has become a popular choice for everyday payments.

What Does Venmo Deposit Mean?

Venmo deposit is a service offered by Venmo that allows users to transfer money from their Venmo account directly into their bank accounts. The process is simple and secure, with funds typically being available within 1-2 business days.

To make a Venmo deposit, users simply need to link their bank account to the app and select “Transfer to Bank” in the main menu. Users can choose how much money they want to move (up to $2,999 per week) and when they want it transferred (same day or 1-2 business days). All transfers are protected by fraud detection technology and financial data security measures. Venmo deposits are perfect for quickly sending money to friends or family, paying bills online, and more. With its fast and secure transactions, Venmo deposit is an ideal choice for digital payments.

Types of Venmo Deposits

Venmo offers several types of deposits for users to choose from. The most common type is the Standard Venmo Deposit, which allows users to transfer money directly into their bank account within 1-2 business days. This type of deposit is ideal for those who need to pay bills quickly or send money to family and friends.

For those looking for an even faster option, Venmo also offers Same Day Deposit. This feature allows users to transfer funds directly into their bank accounts in as little as 30 minutes.

Finally, there’s Express Deposit, which can be used to instantly add funds to your debit card balance. All three types of deposits are protected by fraud detection technology and financial data security measures, so you can rest assured that your payment information is safe and secure when using Venmo.

Bank Account Transfer

Bank account transfers are one of the most convenient ways to quickly send and receive money. With a bank account transfer, you can easily move funds from one bank account to another. All you need is the recipient’s bank routing number and account number.

Bank transfers are usually instantaneous, allowing for fast payments and secure transactions. They’re also cost-effective since there are generally no fees associated with them. Plus, it’s easier to track your expenses with a bank transfer because you can see the funds leaving your account right away. Bank account transfers offer an efficient way to make payments without having to wait in line or worry about carrying cash around with you.

Debit Card Transfer

Debit card transfers are a fast, convenient way to send and receive money. All you need to transfer funds using your debit card is the recipient’s bank routing number and account number. Transfers with debit cards can be processed in as little as a few minutes, meaning that you won’t have to wait around for days or even weeks for your payment to get where it needs to go.

Plus, since there are usually no fees associated with debit card transfers, they can help you save money in the long run. And because it’s easy to track your expenses with a debit card transfer, you don’t have to worry about losing track of how much money you’ve sent or received. Debit card transfers are a great option for those who want an efficient way to make payments without having to wait in line or worry about carrying cash around with them.

Credit Card Transfer

Credit card transfers are a great way to send and receive money quickly and securely. All you need is the recipient’s credit card number and you can transfer money instantly.

Credit card transfers are often a faster method than other payment options, so you don’t have to wait days or weeks for your payment to arrive. Plus, many credit cards offer rewards points when you use them for transfers, which can be used for discounts or cash back.

However, it’s important to check with your credit card issuer before making a transfer as some may impose fees on certain transactions. Credit card transfers also offer more security than other methods of payment as the funds are tracked through the credit card company’s secure system and cannot be lost or stolen along the way. With credit card transfers, you can make payments quickly and securely without having to worry about carrying cash around with you.

Direct Deposit

Direct deposit is a safe and convenient way to receive payments. It allows funds to be sent electronically from an employer or other payer directly into your bank account. This eliminates the need for you to manually deposit checks or worry about lost or stolen payments. Direct deposit also speeds up the payment process, allowing you to access your money faster than if you were waiting on a mailed check.

Plus, there are no fees associated with direct deposits, making them an ideal choice for those who want to save money. To set up direct deposit, you’ll need to provide your bank information and routing number to your employer or payer so they can send the funds electronically. Once setup is complete, all subsequent payments will be deposited directly into your account without any extra effort required on your part. Direct deposits are a safe and secure way to receive payments quickly and easily.

Mobile App Payment Method

Mobile app payment methods are becoming increasingly popular as a convenient way to pay for goods and services. With mobile apps, users can quickly and easily make payments directly from their phone or tablet in just a few taps. This type of payment method is perfect for anyone who wants to avoid carrying cash or dealing with credit cards.

Mobile app payment methods also provide extra security features such as PIN codes and fingerprint identification that help protect your information. To use a mobile app payment method, you simply need to download the app, link it to your bank account or credit card, and then enter the necessary information each time you want to make a purchase. Mobile app payments are quick and easy, making them an ideal choice for those who want safe, secure payments without all the hassle.

Paper Checks and Electronic Terminals

Paper checks are a traditional payment method that is still used in many places. They are a convenient way to pay for goods and services without having to carry cash. Paper checks can be written out to the recipient, or they can be filled out using an electronic terminal.

Electronic terminals allow customers to enter their information quickly and securely, eliminating any risk of fraud. The terminal will then generate a paper check with all the necessary information already filled in. This helps speed up the payment process and eliminates manual errors. Electronic terminals also provide extra security features such as PIN codes, fingerprint authentication, and other encryption methods that help protect both the customer’s and merchant’s information from fraudsters.

How to Make a Venmo Deposit?

Making a Venmo deposit is an easy and convenient way to transfer funds electronically. To get started, first you will need to download the Venmo app and create an account. Once your account is all set up, you can add your bank information by linking it to the app. This allows Venmo to access your bank account and make deposits into it. You can also fund your Venmo account directly through the app itself using a debit card or credit card.

Once you have funded your Venmo account, you are ready to make a deposit! Simply enter in the amount of money that you want to send, select the recipient from your contacts list or enter their email address, and hit “Send”.

The money will be sent instantly and securely and will be deposited into their bank account within minutes. If both parties have verified accounts with Venmo, there won’t be any fees involved in making the transaction. Otherwise, there may be small fees associated with certain types of deposits.

Making a deposit on Venmo is quick and simple – no more waiting around for paper checks or dealing with long lines at electronic terminals! With just a few clicks, you can easily send money wherever it needs to go without worry.

Establishing an Account with Venmo

Establishing an account with Venmo is easy and secure. All you need to do is download the app, create a username and password, and then enter your personal information such as your name, address, phone number, and date of birth. You can also add a valid email address so that you can be contacted if necessary. Once your account has been created and verified, you’ll be ready to start using it!

Venmo allows users to link their bank accounts or debit cards for easy deposits into the app. This makes it convenient for those who want to make payments without having to use cash or checks. It’s also possible to use a credit card for deposits but there may be fees associated with this option. Additionally, users have the option of funding their Venmo accounts directly from the app itself using a debit card or credit card.

Once your account has been established with Venmo, you will be able to send payments quickly and securely without any hassle. With just a few clicks of your mouse or taps of your finger on the screen, money can instantly be sent wherever it needs to go!