How to stop cash app from canceling payments (complete 2023 guide)?

Have you ever had a payment canceled on Cash App without your knowledge or consent? It can be frustrating and confusing, especially if you need that money urgently. So, how can you prevent Cash App from canceling your payments?

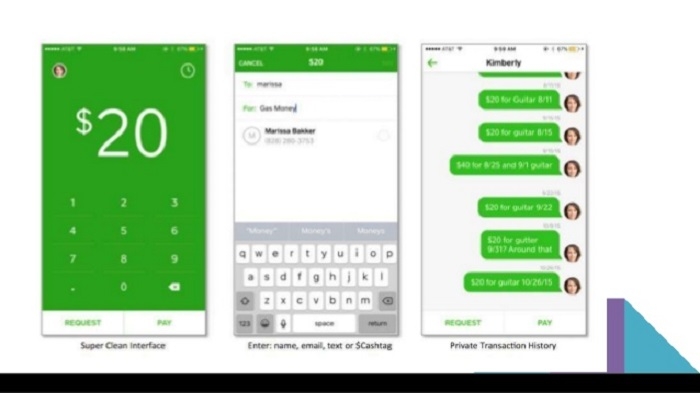

Cash App is a popular mobile payment service that allows users to send and receive money quickly and easily. However, like any other app, it has its own set of problems. One of the most common issues reported by users is the cancellation of payments.

If you’re tired of dealing with canceled payments on Cash App, you’re not alone. Fortunately, there are steps you can take to avoid this problem. In this article, we’ll provide you with a complete guide on how to stop Cash App from canceling payments in 2023. Whether you’re a new user or a seasoned Cash App pro, these tips will help you ensure that your payments go through smoothly and without any hiccups.

What Does It Mean When a Payment Is Canceled on Cash App?

When a payment is canceled on Cash App, it means that the transfer of money was not completed successfully.

This could be due to a variety of reasons, including insufficient funds in your account, an incorrect recipient address, or a technical issue. It can also happen if the payment is blocked by Cash App’s fraud protection system. Regardless of the cause, it’s important to keep in mind that canceled payments are not reversible.

What Does It Mean When Cash App Cancels Payment for Your Protection?

When Cash App cancels a payment for your protection, it usually means that the platform has identified a potential risk with the transaction. This could be due to an incorrect or suspicious recipient address, or if there is not enough money in your account to complete the payment. Cash App’s fraud protection system is designed to safeguard you from online threats by monitoring transactions and blocking any suspicious payments.

How to Stop Cash App From Canceling Your Payments?

If you’re tired of dealing with canceled payments on Cash App, there are a few steps you can take to prevent it from happening again. Here’s what you need to do:

1. Double-Check Payment Details: Before sending money on Cash App, always double-check the payment details. This includes verifying the recipient ‘s name, address, and account number. If you make a mistake or enter incorrect information, your payment may be blocked or canceled by Cash App’s fraud protection system.

2. Use Verified Payment Methods: When sending money on Cash App, always use verified payment methods such as debit cards, bank accounts, and credit cards. This will help ensure that the payment goes through without any problems . Additionally, make sure to use a secure internet connection when sending payments on Cash App.

3. Avoid Sending Money to Unknown Recipients: If you’re sending money to someone you don’t know or trust, it’s best to avoid using Cash App. This is because Cash App’s fraud protection system will likely flag the transaction as suspicious and cancel it without your knowledge or consent.

4. Enable Notifications: You can also set up notifications in the Cash App app to be alerted when payments are canceled. This way, you’ll be able to take action quickly if something goes wrong. Additionally, enabling notifications can help you stay on top of your finances and monitor all incoming and outgoing payments.

5. Contact Support: If a payment is canceled on Cash App and you can’t figure out why, you should contact the Cash App support team for help. The support team will be able to investigate the issue and advise you on how to proceed.

What Does It Mean When Cash App Cancels Payment for Your Protection?

When Cash App cancels a payment for your protection, it usually means that the platform has identified a potential risk with the transaction.

This could be due to an incorrect or suspicious recipient address, an insufficient funds situation in your account, or if there is not enough money in your account to complete the payment. To protect you from online threats and fraud, Cash App’s fraud protection system will monitor transactions and block any suspicious payments.

To ensure you’re making secure payments on Cash App, it’s important to keep your account information up-to-date. Make sure that all financial and personal details are accurate and up-to-date to reduce the risk of payments being canceled due to an incorrect recipient address or an insufficient funds situation in your account. Additionally, you should always use verified payment methods such as debit cards, bank accounts, and credit cards to ensure that payments go through without any problems.

Why Is My Cash App Card Declining for Unusual Activity?

If your Cash App card is declining due to unusual activity, it could be because the platform has identified a potential risk. This could be because of an incorrect recipient address, or if there is not enough money in your account to cover the payment. Additionally, it’s possible that Cash App has detected suspicious activity on your account and wants to protect you from online threats by blocking any payments that look suspicious.

To avoid having your Cash App card declined due to unusual activity, make sure that all financial and personal details are accurate and up-to-date. Additionally, you should always use verified payment methods such as debit cards, bank accounts, and credit cards when making payments on Cash App. Finally, be sure to enable notifications so you can stay on top of your finances and monitor incoming and outgoing payments.

Cash App Intervening for Safety Purposes

Cash App will intervene for safety purposes when it detects a potential risk with a payment. This could be because of an incorrect recipient address, or if there is not enough money in your account to complete the payment. Additionally, Cash App’s fraud protection system will also monitor transactions and block any suspicious payments.

To make sure that payments go through without any problems on Cash App, it’s important to keep your account information up-to-date. Make sure that all financial and personal details are accurate and up-to-date to reduce the risk of payments being canceled due to an incorrect recipient address or an insufficient funds situation in your account. Additionally, you should always use verified payment methods such as debit cards, bank accounts, and credit cards to ensure that payments go through without any problems.

Bank May Block a Transaction

In some cases, banks may block a transaction due to their own fraud protection system flagging the payment. This could occur because of an incorrect recipient address or if there is not enough money in your account to cover the payment.

To prevent this from occurring, make sure that all financial and personal details are accurate and up-to-date. Additionally, you should always use verified payment methods such as debit cards, bank accounts, and credit cards when making payments on Cash App.

How to Prevent Cash App From Canceling Payments?

To prevent Cash App from canceling payments, it’s important to keep your account information up-to-date. Make sure that all financial and personal details are accurate and up-to-date to reduce the risk of payments being canceled due to an incorrect recipient address or an insufficient funds situation in your account.

Additionally, you should always use verified payment methods such as debit cards, bank accounts, and credit cards to ensure that payments go through without any problems. Additionally, be sure to enable notifications so you can stay on top of your finances and monitor incoming and outgoing payments. Finally, if you suspect any suspicious activity on your account, contact Cash App Support immediately for assistance.

Where to Get Help if Cash App Payments are Canceled?

If your Cash App payments have been canceled, you can contact Cash App Support for assistance. You can reach out to the customer service team via email or live chat and explain the situation. The support team will investigate the issue and advise you on how to proceed. If you are unable to resolve the issue, they may be able to refund your payment.

Using Cash App Security Features

To ensure that payments go through without any issues, it is important to take advantage of the security features provided by Cash App. You can activate two-factor authentication on your account to protect your personal and financial information from unauthorized access. Additionally, you can set up a PIN or fingerprint authorization for added security. You should also enable notifications so you are always aware of incoming and outgoing payments.

Verifying Your Payment Method

When making payments on Cash App, you should always use verified payment methods such as debit cards, bank accounts, and credit cards. This reduces the risk of the payment being canceled due to an incorrect recipient address or insufficient funds in your account. You can check that your payment method is verified by going to the Settings tab in Cash App and selecting ‘Banking .’

How to Resolve an Issue With a Failed Payment?

If your Cash App payment failed, the first step is to contact Cash App Support for assistance. The customer service team will investigate the issue and advise you on how to proceed. If you are unable to resolve the issue, they may be able to refund your payment.

If you have experienced a failed payment, the first step is to identify the reason for the failure. This could be due to insufficient funds in your account, an expired credit card, or a technical issue with the payment system. Once you have identified the issue, you should contact the payment provider or the merchant immediately to resolve the problem.

If the issue is due to insufficient funds, you may need to deposit more money into your account, or update your payment information. If it is a technical issue, the payment provider will likely be able to assist you in resolving the problem. In some cases, it may be necessary to cancel the transaction and try again. It is important to act quickly to resolve the issue to avoid any potential late fees or penalties.