Borrowing money using cash app (complete 2023 guide)

Have you ever found yourself in a tight financial situation and needed to borrow money quickly? With the rise of digital payment apps, borrowing money has become easier than ever before. But is it safe and reliable to borrow money through a cash app like Cash App?

Cash App is a popular peer-to-peer payment app that allows users to send and receive money instantly. It has also become a popular platform for borrowing and lending money between friends, family, and even strangers. However, there are risks involved in using Cash App to borrow money, and it’s important to understand the process before diving in.

If you’re considering using Cash App to borrow money, it’s important to know how the process works and what to watch out for. In this complete guide for 2023, we’ll walk you through the steps of borrowing money through Cash App, the potential risks and benefits, and tips for staying safe and avoiding scams. Whether you’re in a financial bind or just curious about the lending landscape of digital payment apps, this guide will give you the information you need to make informed decisions.

How To Borrow Money From Cash App?

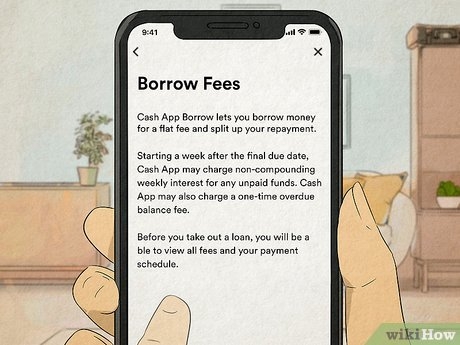

If you’re ready to borrow money from Cash App, the first step is to make sure you understand the process and all of its associated risks. To start, open Cash App on your device and select the “Borrow Money” option from the main menu.

You’ll then be prompted to enter information about yourself such as name, address, date of birth, etc. After you complete this step, you’ll be asked to connect a bank account to your Cash App account.

Once you’ve established your Cash App account and linked a payment method, you can then search for and select an offer from a lender. Each lender will have different terms and interest rates associated with their loan, so it’s important to read through the details of each offer carefully before committing.

Once you’ve selected an offer and accepted the terms, the lender will then transfer the money to your Cash App account. Depending on the loan terms, you may receive the funds immediately or within a few hours. Once you’ve received the funds, it’s important to make sure that you make all of your payments on time in order to avoid any additional fees or penalties.

Risks and Benefits of Borrowing Money Through Cash App

Using Cash App to borrow money can provide you with quick access to funds when you need them, but there are some risks associated with this type of short-term loan. One of the biggest risks is that lenders may charge higher interest rates than traditional loans. This means that if you don’t pay off your loan in time , you could end up paying more in interest than you would with a traditional loan.

In addition to the potential for higher interest rates, there’s also the possibility of encountering fraud or scams when using Cash App to borrow money. It’s important to be aware of any suspicious activity and report it immediately in order to protect yourself from becoming a victim.

Despite these risks, there are also several benefits to borrowing money through Cash App. For one, it’s a convenient and quick way to access funds when you need them. You can also compare different loan offers and select the one that works best for your needs. Finally, Cash App supports both credit card and debit card payments, so you can use whichever payment method is most convenient for you.

Tips for Staying Safe When Borrowing Money Using Cash App

Borrowing money through Cash App can be a great way to access funds quickly, but it’s important to stay safe and protect yourself from fraud. Here are some tips for staying safe when borrowing money using Cash App:

• Make sure you understand the terms and conditions of any loan you take out. Check the interest rate and repayment terms to make sure you’re comfortable with them.

• Make sure the lender is legitimate by researching their business and checking reviews online. Don’t accept any offers from lenders you don’t feel comfortable with.

• Never share your personal information or financial details with anyone when using Cash App. This includes your bank account numbers, passwords, social security number, etc.

When borrowing money through Cash App, it’s important to be aware of the potential risks and take steps to protect yourself. Be sure to read all of the fine print associated with any loan you take out so that you are informed about the terms and conditions before committing.

It’s also a good idea to research lenders before taking out a loan, as well as check reviews online to ensure you’re dealing with a legitimate company. By following these tips, you can stay safe and protect yourself when borrowing money through Cash App.

Making Payments on Your Cash App Loan

Once you’ve taken out a loan with Cash App, it’s important to understand the repayment terms and make sure you are able to meet them. Depending on the lender, you may be able to make payments weekly, bi-weekly or monthly. It’s important to read through your loan agreement carefully in order to understand the repayment schedule.

If you’re having trouble making payments on time, it’s a good idea to reach out to your lender as soon as possible. Some lenders may be able to help you adjust the repayment schedule or offer other options for paying back the loan. It’s also important to remember that late payments may result in additional fees or penalties, so it ’s best to stay on top of your payments.

Using Cash App to borrow money can be a great way to access funds quickly, but it’s important to stay safe and protect yourself from fraud. Be sure to understand the loan agreement, research lenders and make payments on time in order to ensure a successful borrowing experience with Cash App.

When using Cash App to borrow money, it’s important to be aware of any potential risks and take steps to protect yourself. Before taking out a loan, make sure you read all of the fine print associated with it and are comfortable with the terms and conditions.

It’s also a good idea to research lenders before committing to any loan, as well as check reviews online for legitimacy. Finally, be sure to make payments on time in order to avoid any additional fees or penalties. By following these tips, you can successfully and safely borrow money through Cash App.

Probability of Cash App Scams vs. Viva Payday Loans Scams

Cash App scams are becoming more and more common as the app grows in popularity. While Cash App does offer various security measures to protect users, it’s still important to be aware of the potential risks associated with using the service.

For example, fraudulent lenders may try to take advantage of unsuspecting users by offering loans that have unreasonably high interest rates or hidden fees. Additionally, scammers may attempt to steal user information or payment data.

On the other hand, Viva Payday Loans is a reliable source of short-term loan options. While there may be some scam artists out there who are trying to take advantage of borrowers, Viva Payday Loans itself has an excellent reputation and is committed to protecting its customers’ rights. Additionally, Viva Payday Loans offers several security measures to protect users from fraudulent lenders, including a secure application process, identity verification, and an online dispute resolution system.

Ultimately, while both Cash App and Viva Payday Loans have their own sets of risks associated with them, users can stay safe by understanding the terms and conditions of any loan they take out and researching potential lenders beforehand.

When taking out a loan with Cash App or Viva Payday Loans, it’s important to understand the repayment terms and make sure you are able to meet them. Both companies offer various options when it comes to repayment schedules, so make sure you’re familiar with the terms before committing to any loan.

If you’re having trouble making payments on time, be sure to reach out to your lender as soon as possible. Finally, remember that late payments may result in additional fees or penalties, so it’s best to stay on top of your payments.

How to Apply for Cash with Viva Payday Loans in Quick Steps

Applying for a loan with Viva Payday Loans is quick and easy. Simply follow these steps to get started:

1. Visit the Viva Payday Loans website and fill out an online application form.

2. Provide the necessary documents such as proof of income, bank statements, and other supporting documentation as required.

3. Receive an instant decision on your loan.

4. Sign the loan agreement electronically and receive your funds within 24 hours.

By following these steps, you can easily apply for a loan with Viva Payday Loans and get the money you need in no time.

Borrowing Responsibly with Cash App and Viva Payday Loans

When taking out a loan, it’s important to be sure you can afford the repayment plan. Be sure to look at your budget and current expenses before taking out a loan so you know what you can reasonably afford. Additionally, consider how long the repayment period is and if you need more time to pay off the loan, some lenders may offer extended repayment plans.

Finally, be sure to read all the terms and conditions of any loan thoroughly before signing a contract. That way, you can know exactly what you’re getting into and avoid any potential issues down the line. By following these tips, you can safely and responsibly borrow money through Cash App or Viva Payday Loans.