Chime® mobile check deposits (complete 2023 guide)

Do you want to make secure check deposits on the go? If so, then Chime’s Mobile Check Deposit feature is the best option for you. This guide explains the entire process of putting money in your account with just a few taps and clicks.

Financial institutions across the world have embraced mobile banking platforms to provide efficient services to their customers. With these platforms, customers can conveniently perform regular transactions like transferring money, paying bills, and making deposits electronically.

Chime Mobile Check Deposit is an online service that allows you to deposit physical checks into your account without going to a branch or ATM. It is simple, fast, and secure – perfect for those busy times when you need to take care of financial matters quickly. This complete guide shows how easy it is to make a deposit with Chime by explaining every step of the process from start-to-finish.

How to use mobile check deposits in the Chime app?

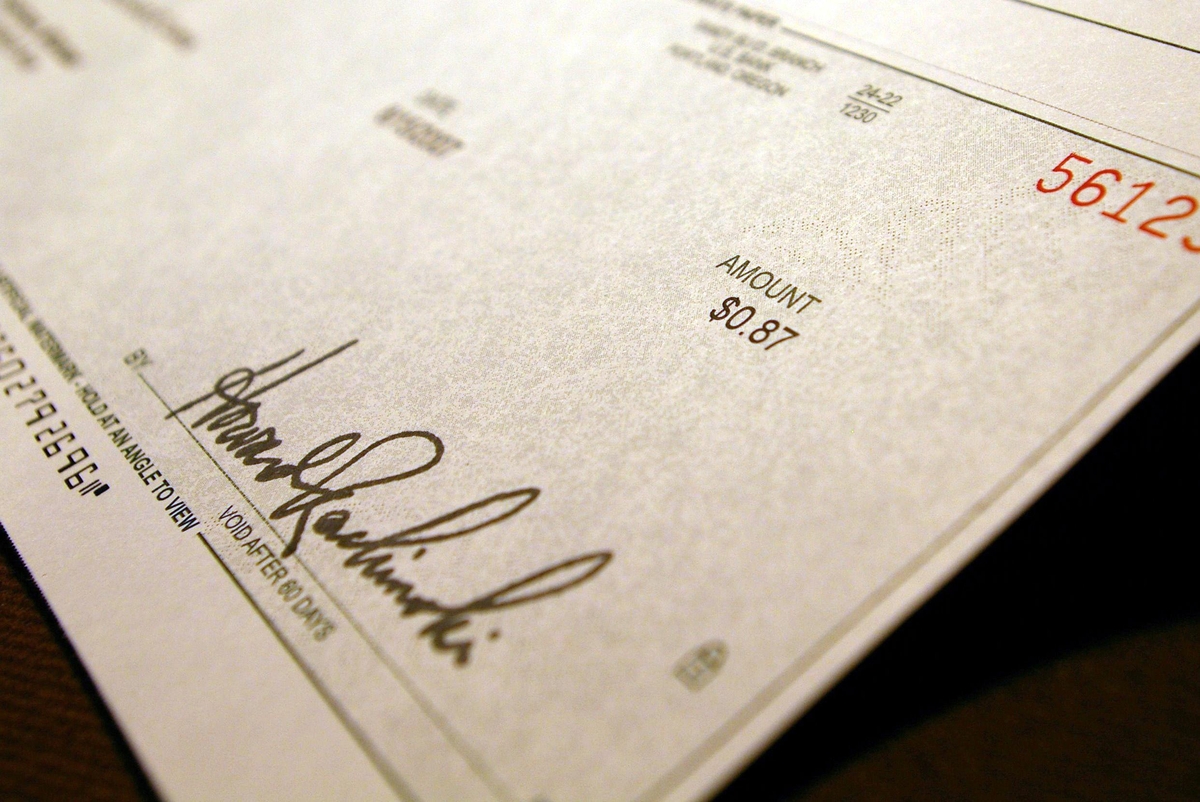

Using the mobile check deposit feature in the Chime app is a convenient way to quickly fund your account without having to leave your home. As a first step, it’s important to verify that the name printed on your paper check matches exactly with what’s listed in your Chime Checking Account. The next step is for you to sign the back of the check. Once this has been completed, you can open Chime and navigate to ‘Move Money’ at the bottom of your screen. From there you will then choose ‘Mobile Check Deposit’ which will take you through a series of in-app prompts that will walk you through the remainder of the process.

The entire process should take no more than five minutes and is a reliable way to add funds into your Chime account whenever needs be. Be sure to always double-check all necessary information as well as confirm all amounts before submitting your check as once submitted it cannot be reversed or cancelled. Furthermore, recent versions of Chime provide users with an additional layer of security by using photo-verification technology which helps validate the authenticity of any checks being uploaded into their accounts.

Who can use Chime’s mobile check deposit?

Chime mobile check deposit is a convenient way for Chime members to easily and conveniently deposit their checks. With this service, members can deposit a check directly from their phone without having to go into the bank or wait in line. To be eligible for Chime’s mobile check deposit, the user must have performed at least one direct deposit of $1 or more from an employer, payroll company, gig economy payer, or government benefits provider. The check must also meet certain criteria such as being written in US dollars, dated within the last six months, not previously deposited at another institution and free of any illegible items or signs of fraud.

This service gives customers greater control over their finances since they’re able to easily and quickly deposit checks from anywhere with a WiFi connection and smartphone. Not only does this eliminate the need for users to physically go to a bank location but it also saves them time by allowing them to do everything remotely. Additionally, customers can rest assured knowing that all deposits are protected by Chime’s Security Guarantee so their funds remain safe and secure.

Is Chime’s mobile check deposit instant?

Chime’s mobile check deposit is not an instantly available option, and it can take up to 5 business days for your funds to show up in your account after depositing a check. This waiting period, however, typically doesn’t stretch beyond one or two business days. The delay is intended to protect customers from potential issues with the checks they’re depositing – it stops bounced checks from causing difficulties down the line, while also allowing Chime to process more deposits through their app.

Right now, there is no way around the hold time that comes with using a mobile check deposit on Chime – but this wait isn’t indefinite or especially long. The wait time might be frustrating to some, but it has been implemented for a reason: To protect both customers and the company from any complications that could arise from transactions going through too quickly.

Can you see a pending deposit in the Chime app?

If you are using the Chime mobile app, you can easily view your pending deposits. On the Activity page of the app, deposits that have not yet been credited to your account will appear in gray. This means that you won’t be able to access these funds until they are accepted. As soon as Chime approves and processes the deposit, it will change from gray to green and the money will be available for you to use.

Seeing your pending deposits on the Chime app is a great way to keep track of how much money you are expecting or any new deposits coming in. You can also set up notifications so that you always know when a deposit has been accepted and your funds have become available. Being able to keep an eye on your pending deposits ensures that you stay on top of incoming payments and never miss out on any expected money.

What to keep in mind for Chime mobile check deposit?

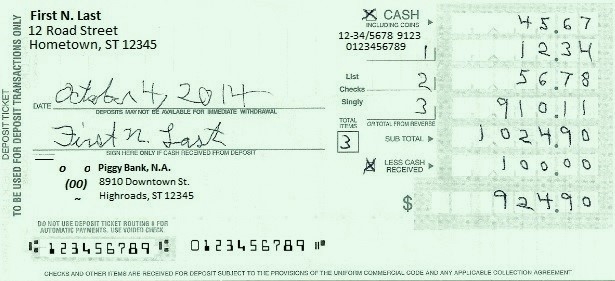

When it comes to mobile check deposits, there are certain steps you should take to ensure that your deposit is accepted without any problems. First of all, make sure the photo you take of the check is clear and provides all necessary information. This means that all four corners of the check should be visible in the picture and all writing must appear legible when zoomed in. Additionally, Payable items such as cashier’s checks and money orders issued by banks are typically accepted while other types such as travelers’ checks, foreign currency or third-party checks may not be accepted.

Additionally, remember to include other details like your signature on the back of the check when taking photos and make sure to clearly date the check for an accurate analysis. Moreover, some items such as corporate payroll checks and government checks might also require additional verification steps during account setup so keep this in mind when setting up your account. If you have any more questions regarding mobile check deposits on Chime Mobile banking app feel free to reach out to their customer service representatives for further help.

How to take a picture of your check?

Taking a clear picture of your check can be key to making sure that your mobile check deposits are accepted quickly and without hassle. It’s not just about convenience, but also making sure your money is where it needs to be faster. To make sure you have the best results with taking a picture of your check, there are some easy tips you can remember:

First, find a dark background and set the check out on it. This will help ensure that no extra lighting or lines from a patterned surface will interfere with what’s being photographed. Make sure you are using bright natural light or an artificial light source to keep the image looking crisp and letting all the information show fully on the document. Your camera should be focused correctly so that all four corners of the check are clearly visible in the photo – if even one corner is hidden, your bank may reject it, causing delays for you. Finally, avoid taking pictures in direct sunlight as this can wash out most details on the document – meaning all your effort will be for nothing! Following these simple steps guarantees that once snapped, you can sit back knowing that wherever you are sending off your image, it should come through without any issues.

What is Chime’s mobile deposit limit?

Chime is an online banking platform that allows its users to deposit checks just by using their mobile phones. It simplifies the process without having people go to a physical bank or ATM. The initial total monthly check deposit limit for Chime members is $10,000, with each check limited to a maximum value of $2,000. Additionally, members can only deposit up to 10 checks per month until they reach their total monthly deposit limit.

When members use Chime’s mobile services frequently, they may have higher deposit limits than the initial ones. With a good history of deposits and other financial activities done on Chime’s platform, these customers may benefit from higher monthly limits and more flexibility with their transactions. This makes it easier and faster to manage their financial life from anyplace, anytime – all with the power of their mobile devices alone.