Chime® account suspended (why & what to do)

Have you ever had your Chime® account suspended? It can be a frustrating experience not knowing why your account was suspended or what steps to take to resolve the issue.

Chime® is a popular online bank that provides users with no-fee banking options. However, just like any other financial institution, Chime® has rules and regulations that users must abide by. Violating these rules can result in a suspended account.

If you have experienced a Chime® account suspension or fear it could happen to you, it’s important to understand why it happens and what steps you can take to resolve the issue. In this article, we will discuss the common reasons behind a Chime® account suspension and provide guidance on how to get your account back up and running.

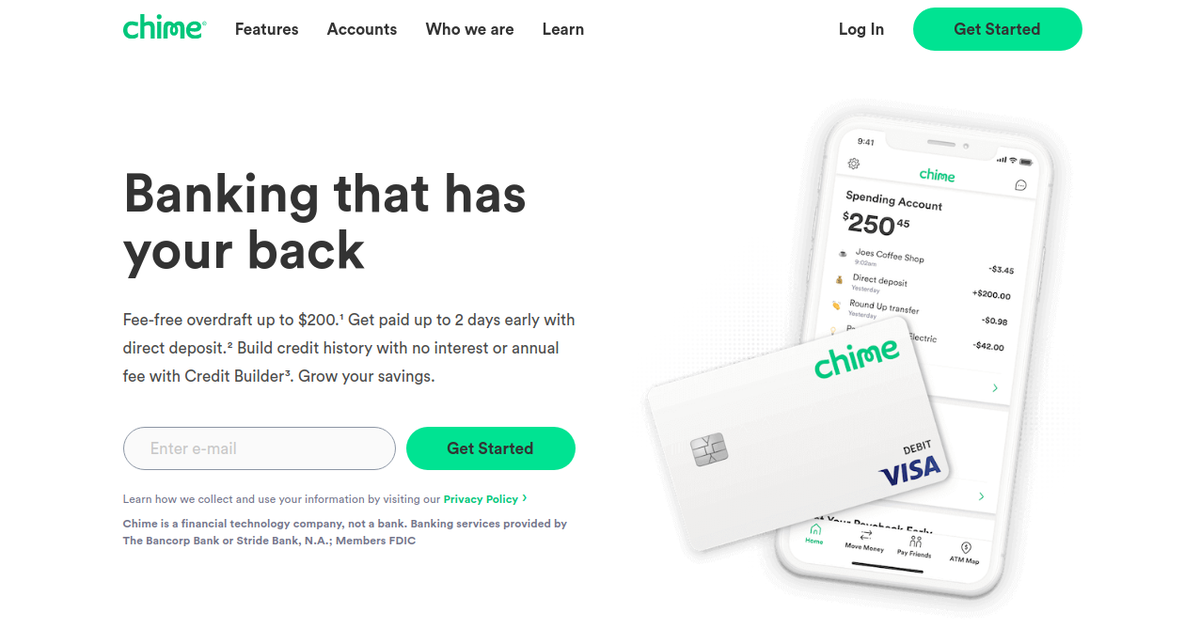

Overview of Chime® Accounts

Chime® is an online banking platform that provides users with a range of features to help them manage their finances. From the ability to easily transfer money between accounts, set up direct deposits, and save money automatically with their Save When You Spend program, Chime® offers customers a convenient way to keep track of their finances. However, if you don’t follow the rules set forth by Chime®, your account could be suspended.

When your Chime® account is suspended, it means that you are not able to access any of the services available on the platform. This includes transferring money between accounts or withdrawing funds from ATMs. In addition, any payments or transfers already scheduled will not be processed until your account is reinstated.

The reasons for an account suspension can vary from violating policies such as fraud or unauthorised access to simply having too many incorrect login attempts in a short span of time. Regardless of the reason for suspension, users must contact [email protected] as soon as possible in order to have their accounts reinstated and regain access to their financial information and services.

What is a Suspended Account?

A suspended account is a user account that has been temporarily disabled by the service provider. This means that any services associated with the account, such as transferring money or withdrawing funds from ATMs, cannot be accessed until the suspension is lifted. Generally, this can occur for several reasons including violations of policies such as fraud or unauthorized access or too many incorrect login attempts in a short span of time. In most cases, users must contact the service provider to have their accounts reinstated and regain access to their financial information and services.

Reasons for Account Suspension

Account suspension can occur for a variety of reasons. One common reason is fraud or unauthorized access, which occurs when someone other than the account owner attempts to access the account. Another cause of suspension may be too many failed login attempts in a short period of time, which can indicate possible hacking or malicious behavior. Additionally, violations of terms and conditions or other policies may lead to an account being suspended. In some cases, accounts can also become suspended due to suspicious activity, such as large and/or unusual transactions that do not match the user’s typical spending patterns.

No matter what the reason for suspension is, users must contact their service provider to have their accounts reinstated. Service providers may require verification documents and other information in order to complete this process and ensure that no unauthorized activity has occurred on the account. By following these steps, users can regain access to their financial information and services associated with their accounts.

Suspected Fraudulent Activity

Suspected fraudulent activity can lead to an account suspension. This is when the service provider suspects that something suspicious is going on with the account and wants to protect the user from any potential harm. Common examples of suspicious activity include large and/or unusual transactions that do not match the user’s typical spending patterns, multiple failed login attempts in a short period of time, or unauthorized access attempts.

If any of these activities occur, users may be asked to provide verification documents and other information to prove their identity and ensure that no fraud has occurred. It is important for users to respond promptly when they receive such requests, as this will help prevent the suspension of their accounts and ensure continued access to their financial information.

Error Code/Error Messages

Error codes and error messages are common occurrences when using technology. They appear when something unexpected or incorrect happens, such as a program crashing or running into an issue that prevents it from completing its task. Error codes and messages can help users identify the source of the problem so they can take steps to fix it.

Error codes are usually numeric codes that correspond to specific technical issues. For example, a code such as 404 Not Found indicates that the requested web page could not be found on the server. Meanwhile, error messages are usually more descriptive than their corresponding code counterparts, providing more detail about what went wrong and how to address it. Common error messages include “Out of memory” or “Device driver not installed”.

Knowing what type of error you’re dealing with is key to figuring out how to solve it. If you receive an error code or message, make sure to document it before seeking out a solution online or consulting an IT specialist for advice.

Incorrect Email Address

An incorrect email address can lead to a number of errors and issues when sending emails. If you’ve sent an email but haven’t received a response, the first thing you should do is check that the email address is correct. Even if only one letter or number is wrong, the message may never reach its intended recipient.

To avoid sending messages to incorrect addresses, double-check any contact information before hitting “Send”. If possible, try to verify the accuracy of an email address with the recipient before sending them a message. Additionally, use spell-checkers and other tools whenever possible to reduce the likelihood of typos.

Finally, if you’ve made a mistake in entering an email address in your address book, take time to update it as soon as possible so future messages don’t go astray. Taking these steps will help ensure that all your emailed messages reach their intended recipients without any problems.

Violation of Bank Policies and Terms of Use

When you decide to open a bank account, it is important to understand the terms and conditions of use. Violating the policies and terms can lead to serious consequences, such as having your account suspended or even closed.

Bank policies are designed to protect both the bank and its customers from potential fraudulent activities. This means that if you fail to abide by these terms, your account could be at risk of being frozen or closed. It is essential that you read and understand all of the bank’s policies and terms prior to opening an account, so that you are aware of any restrictions or prohibitions in place.

To avoid any issues with your account, make sure you follow all bank policies and terms of use. Keep records of all transactions made with your account and review them regularly for accuracy. If something looks suspicious, contact your bank immediately so they can investigate further.

Additionally, ensure that you update your contact information on file with the bank whenever necessary so that they can get in touch with you when needed should any issues arise. Taking these steps will help keep your account in good standing with the bank and prevent any unnecessary problems down the line.

Consequences of a Suspended Account

Having a Chime® account suspended can be inconvenient and even costly. When an account is suspended, the user will no longer have access to their funds or be able to make any transactions with their account. This means that any automatic payments or scheduled transfers will not take place, which could lead to late fees and other expenses.

Additionally, any pending deposits or payments may also be affected, meaning the user may not receive money they were expecting or be responsible for paying bills they thought would be taken care of automatically.

When a Chime® account is suspended, it is important to act quickly in order to resolve the issue as soon as possible. Contacting customer service and providing all necessary documents for verification should help expedite the process and get your account back up and running in no time.

However, if the suspension is due to violations of bank policies or terms of use, additional steps may need to be taken before your account can be reinstated. It is important to stay in communication with the bank throughout this process so you are aware of what’s going on with your account at all times.

Loss of Access to Your Funds

When your Chime® account is suspended, you will no longer have access to your funds. This can cause serious issues if you were relying on automatic payments or scheduled transfers for bills, rent, or other important payments.

Additionally, any pending deposits or payments may not be processed, which could leave you in the lurch financially. If this happens, it is important to contact customer service as soon as possible so they can help get your account reinstated and provide access to your funds again. It is also advisable to check the bank’s policy or terms of use to make sure you are in compliance with all rules and regulations so there will be no further issues in the future.

Inability to Use Services

When your Chime® account is suspended, you will not be able to use the services associated with it. This could include things such as bill pay, direct deposits, transfers, and other features of the banking platform.

Additionally, you will no longer be able to get assistance from customer service or access any of your account information until the suspension has been lifted. If this happens to you, it is important to contact customer service immediately in order to resolve the issue as soon as possible. Depending on what caused the suspension, they may require additional information from you in order to verify your identity and lift the suspension so that you can use their services again.

Conclusion

The preservation of a Chime® account is paramount to its security and performance. Following the steps outlined in this article will help keep your account safe and secure, preventing any future suspensions from occurring.

Regularly monitor your accounts and transactions, avoid sharing your login information with others, stay up-to-date on security updates and patching, utilize maximum socket overrides configurations, be aware of essential cookies and performance cookies, adjust cookie preferences from time to time, and collect anonymous statistics about user behaviour. By implementing all of these measures together, you can ensure that your Chime® account remains secure and uninterrupted.