Robinhood covered calls [complete 2023 guide]

Are you looking to make some extra money on the side? If so, then Robinhood Covered Calls might be the way to go. It’s an exciting stock trading strategy that can help increase your profits — but it can also be risky if you don’t know what you’re doing.

Robinhood Covered Calls is an options trading strategy that captures short-term gains by placing trades on stocks and index funds. In this strategy, a trader buys or holds a particular asset and sells call options against the underlying asset in order to produce additinal profits from moves in the markets. It’s becoming increasingly popular among traders, who are looking for ways to hedge their portfolios or boost returns without taking on too much risk.

This guide will break down the basics of Robinhood Covered Calls in an easy-to-understand manner and explain how it works in detail with real-world examples. We will also provide tips and advice on how best to use this strategy when it comes to fatfing your wealth as well as provide some links to resources that can help you get started making money with Robinhood Covered Calls today!

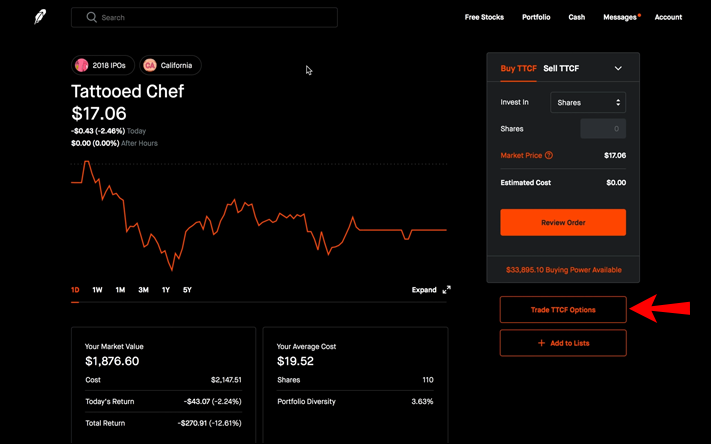

Introduced in 2013, Robinhood has become one of the most popular stock trading app for many investors. With its low or no fees, it has allowed customers to trade stocks, crypto and options with ease. One of the ways traders have used this tool is by writing Covered Calls. Writing Covered Calls requires a working knowledge of the various fees and risks associated with trading stock options on Robinhood.

This guide will provide you with everything you need to know about writing Covered Calls on Robinhood in order to maximize your profits and reduce any risks involved. We’ll cover topics like understanding option premiums, choosing strikes prices, when to close an option position, tracking gains/losses over time, and more!

Robinhood Covered Calls

Robinhood Covered Calls is a great way to make money with options trading. This strategy involves buying or holding an underlying asset and selling call options against it in order to generate additional profits. By understanding the fees and risks associated with this strategy, you can maximize your profits while minimizing any potential losses.

When writing covered calls, investors need to pick an appropriate strike price that is close to the current market price. If the underlying asset rises above the strike price, investors can capture profits from the option premium and any increases in the underlying asset’s value. On the other hand, if the underlying asset falls below the strike price, investors may suffer losses due to declines in the value of their position.

It’s important to be aware of fees associated with Robin hood Covered Calls. Robinhood charges a $10 commission for options trades, and an additional fee for options exercise or assignment. There are also other market data fees that may apply.

Tips for Utilizing Robinhood-Covered Calls

1. Use a stop-loss order: A stop-loss order is an automated exit strategy to limit losses when trading covered calls on Robin hood. This can help prevent you from suffering large losses if the underlying asset moves against your position.

2. Track your gains/losses: Tracking your gains and losses over time is essential to understanding how successful your Robinhood Covered Calls strategy is performing. It’s important to be aware of any fees associated with options trading, as these will reduce your overall profits.

3. Monitor the underlying asset: It’s important to monitor the underlying asset that you are trading options against. Pay attention to any news or trends that may affect the price of the asset and adjust your positions accordingly.

4. Use a calendar spread: A calendar spread is a strategy used when writing covered calls on Robinhood where you buy and sell call options with different expiration dates. This can help you capture more profits or limit losses depending on the direction of the underlying asset.

What are the Benefits of Robinhood Covered Calls?

Robinhood Covered Calls can provide investors with a great way to generate additional income. By understanding the various risks and fees associated with options trading, investors can use this strategy to maximize their profits while minimizing any potential losses.

Additionally, Robinhood offers low or no commissions on trades, which can help save money when trading stock options. Finally, investors can use the stop-loss order strategy to limit losses if the underlying asset moves against their positions.

Understanding Option Premiums

Option premiums are the fees charged for trading stock options on Robinhood. These can vary depending on the type of option being traded, so it’s important to understand them before engaging in any trades.

The option premium is made up of two components: the intrinsic value and the extrinsic value. The intrinsic value is the difference between the strike price and the current market price of the underlying asset. The extrinsic value is the remaining cost of the option.

Timing Your Trades

Timing your trades is a key factor in successful options trading. When trading with Robinhood Covered Calls, you should pay close attention to the expiration dates of your call options. If the underlying asset has moved in your favor, you may want to close out your position before the expiration date to lock in profits.

On the other hand, if the underlying asset has moved against you, you may want to wait until the expiration date to limit losses.

In addition to understanding the basic structure of Robinhood Covered Calls, it’s important to understand how to time your trades. Pay attention to market news and trends that may affect the price of the underlying asset when writing covered calls. This can help you decide when it is best to close out positions or let them expire.

It is also important to use other trading strategies in combination with your Robinhood Covered Calls to help maximize profits. For example, you can use a calendar spread when writing covered calls to capture more profits or limit losses depending on the direction of the underlying asset.

Risk Management and Hedging Strategies

When trading Robinhood Covered Calls, risk management is essential to ensure that losses are kept to a minimum. One way to manage risk is by using stop-loss orders. This allows you to set a maximum amount of losses if the underlying asset moves against your position.

Another strategy for managing risk is hedging. Hedging involves taking a position in the underlying asset and a call option that will offset any losses if the asset moves against you. This can help limit your losses and provide an additional return on your investment.

Understanding Market Volatility

It is important to understand the market volatility when trading Robinhood Covered Calls. This strategy relies on the underlying asset’s price moving in the desired direction, so it is important to be aware of any market news or events that could affect the asset’s price.

Additionally, understanding the implied volatility of an option can help you decide when to close out positions or let them expire.

Taking Advantage of the Low Fees

One of the biggest advantages of trading options on Robinhood is the low or no commissions. This can help save money when trading stock options and increase your overall profits. It’s important to remember that even though there are no commissions, there are still option premiums you must pay when trading covered calls.

It is also important to consider other fees associated with trading options on Robinhood, such as margin fees.

Taking Advantage of Tax Benefits

One of the other advantages of trading Robinhood Covered Calls is the potential for tax benefits. Options gains are generally treated as long-term capital gains, which can result in lower taxes compared to short-term gains from selling stocks. However, it is important to understand the specific tax laws in your jurisdiction before engaging in any options trades.

Using Leverage for Maximum Profits

When trading Robinhood Covered Calls, using leverage can help maximize profits. Leverage allows traders to open larger positions with a smaller amount of capital. This can help increase potential returns while also limiting your risk exposure. It is important to remember that with greater leverage comes greater risk, so it is important to use it wisely and carefully monitor your positions .

Leverage is a great way to maximize profits and accelerate business growth. Through the use of debt or other financial instruments, you can acquire assets that produce income faster than you would be able to if you had to purchase them outright with your own money.

If leveraged correctly, not only can businesses generate more income than they could have without leverage, but also benefit from tax advantages associated with certain loan products. When used responsibly, leverage can be an extremely valuable tool in your entrepreneurial arsenal – however, it does come with risk and should be pursued carefully.

Call vs. Covered Calls What’s the Difference?

One of the primary differences between a call option and a covered call is that the former is not necessarily accompanied by an underlying asset.

A call option provides the buyer with the right, but not the obligation, to buy an underlying asset at a predetermined price before a certain expiration date. The buyer of a call option can take advantage of potential price appreciation in the underlying asset without actually owning it.

The difference between a call option and a covered call option is the level of risk present in each. A call option is when the investor purchases the right, but not the obligation, to buy a stock at a certain price within a certain time frame.

On the other hand, a covered call means that the investor also owns shares of the underlying stock which they can deliver if needed to fulfill their options contract – hence covering their position. Therefore, with covered calls, investors are able to reduce their risk and generate income from the ownership of shares while still obtaining potential returns from the appreciation of share prices.