Does chase work with cash app? (complete 2023 guide)

If you’re someone who frequently uses mobile payment apps, you may be wondering if two of the most popular apps, Chase and Cash App, can work together. With so many options available, it’s important to know which apps can be integrated with each other to make your financial life easier.

Both Chase and Cash App have become increasingly popular in recent years, with millions of users relying on them for their daily financial needs. However, not all apps are compatible with each other, leading to confusion and frustration for users.

As the world becomes more digitally connected, mobile payment apps like Cash App are becoming increasingly popular. But what happens when you need to transfer money from your Chase bank account to your Cash App account? Does Chase work with Cash App?

If you’re a Chase or Cash App user, you may be wondering if these two apps can work together. In this comprehensive guide, we’ll explore whether or not Chase works with Cash App, and provide you with all the information you need to make informed decisions about your finances in 2023.

What is Chase?

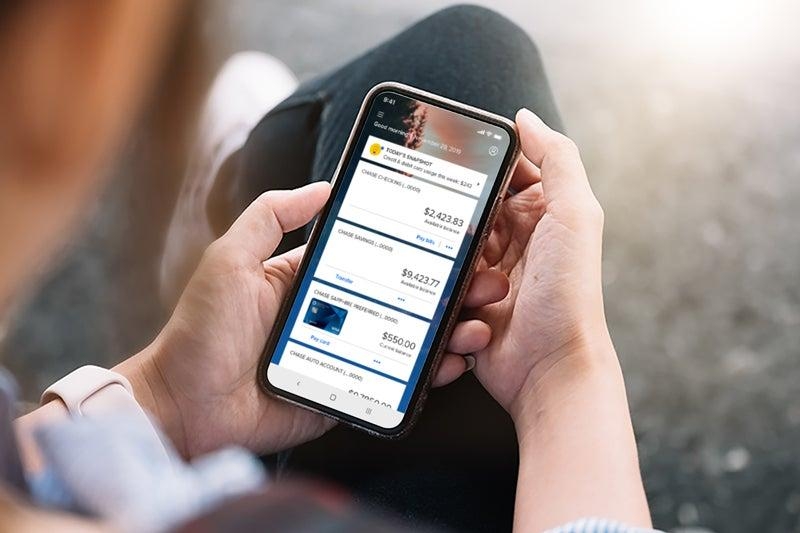

Chase is one of the largest financial institutions in the United States, with over 5,100 branches and 16,000 ATMs nationwide. It offers a wide range of banking services, including checking and savings accounts, credit cards, mortgages, and personal loans. Chase also provides online banking services through its website and mobile app.

Chase is a financial services company that offers a wide range of products and services, including personal and commercial banking, credit cards, mortgages, loans, and investment management. It is one of the largest banks in the United States, with over 4,700 branches and 16,000 ATMs nationwide.

Chase’s parent company, JPMorgan Chase & Co., is a global financial institution that operates in more than 100 countries and serves millions of customers around the world. Chase is known for its innovative digital banking solutions, such as its mobile app and online banking platform, which make it easy for customers to manage their finances on the go.

What is Cash App?

Cash App is a mobile payment app that allows users to transfer money between individuals. It also offers a range of services including digital payments, online shopping, and stock trading. Cash App is available for both iOS and Android devices and has become increasingly popular in recent years.

Cash App is a mobile payment service developed by Square, Inc. that allows users to send and receive money from friends and family. It is available for download on both Android and iOS devices and can be linked to a bank account or debit card.

Cash App allows users to send money instantly without any fees, and also offers a Cash Card that can be used to withdraw money from ATMs or make purchases at retailers. The app also offers other features such as the ability to buy and sell Bitcoin and invest in stocks. Overall, Cash App provides a convenient and easy-to-use platform for mobile payments and financial transactions.

Does Chase Work With Cash App?

Unfortunately, no. Chase does not currently have any integration with Cash App, so you can’t directly transfer money from your Chase account to your Cash App account. However, there are some workarounds that you can use to move money between the two accounts.

For example, you can link a debit card or bank account to your Cash App account and use it to deposit money into your Cash App account. You can then use this deposited money to make payments through the app.

Yes, Chase Bank does work with Cash App. Cash App is a mobile payment service that allows users to send and receive money from their friends and family. Users can link their bank accounts to Cash App to add or withdraw funds. Chase Bank is one of the many banks that is compatible with Cash App.

To link a Chase Bank account to Cash App, users need to enter their Chase account information into the app. Once the account is linked, users can easily transfer funds between their Chase account and Cash App account. However, it is important to note that some users may experience issues with linking their Chase account to Cash App due to security concerns.

What are the Alternatives?

If you don’t want to use Cash App, there are many other alternatives available for online payments. Some of these include PayPal, Venmo, Zelle, Google Pay, Apple Pay and even traditional banks like Wells Fargo or Bank of America. All of these services allow users to transfer money between bank accounts with ease and convenience.

This guide has provided an overview of whether Chase works with Cash App and what are the alternatives. While you can’t directly link your Chase account to Cash App, there are still ways you can transfer money between the two accounts. Additionally, there are other payment services that you can use for online payments.

One of the more popular payment services that are compatible with Chase is PayPal. With PayPal, users can easily send and receive money to friends and family or make payments online. It also offers a debit card feature where you can link your bank account to your PayPal account and use it to make purchases at retailers.

Another option is Venmo, which allows you to quickly send money between friends and family. Venmo also offers a debit card that you can use to make purchases at retailers or withdraw money from ATMs.

Overall, there are many payment services available for online payments, and Chase is compatible with most of them. If you’re looking for an alternative to Cash App, consider signing up for a service like PayPal or Venmo to make transfers and payments easier.

One of the most popular payment services around is Google Pay. With Google Pay, you can easily send money to friends and family or make purchases online using your bank account or debit card. It also offers a feature called Google Wallet which allows you to store money in an online wallet that you can use for purchases or transfers. You can also link your Chase account to Google Pay, making it easier to transfer money between your accounts.

Finally, Apple Pay is another option for online payments. It’s a mobile payment service that allows you to store your cards and make purchases quickly and securely. You can also link your Chase account to Apple Pay and easily transfer money between the two.

How Do I Transfer Money Between Chase and Cash App?

If you want to transfer money between your Chase account and Cash App, the easiest way is to first link your bank account to Cash App. You can do this by entering your Chase account information into the app. Once your accounts are linked, you can then easily transfer funds from Chase to Cash App and vice versa.

If you’re looking for an alternative way to transfer money between Chase and Cash App, you can also use a wire transfer. A wire transfer is a secure way to move money from one bank account to another. It’s usually faster than other methods, such as transferring via paper check or using a debit card. To make a wire transfer from your Chase accounts to Cash App , you’ll need to provide the receiving bank’s routing and account numbers.

Where Can I Find More Information?

For more information about how to link your Chase account to Cash App, as well as other payment services, you can visit the official websites of the payment companies. Additionally, many banks and financial institutions provide helpful tutorials and information about online banking and payments. You can also contact a customer service representative at your bank for more details.

If you’re looking for a secure and convenient way to send money between Chase and Cash App, you may want to consider using a money transfer service. Services like Western Union, TransferWise, and MoneyGram make it easy to send funds quickly and securely. All you need is the recipient’s contact information and bank account details. The service will provide you with a unique reference number which you can use to track the progress of your transfer.

When it comes to transferring money between Chase and Cash App, there are a few other options to consider. One option is using a prepaid debit card. Prepaid debit cards typically have no fees associated with them and can be used to make purchases or withdraw cash from ATMs. All you need to do is add funds to your card by linking it with your bank account. Once the funds are loaded, you can then use the card to transfer money between Chase and Cash App.

Overall, there are many ways to transfer money between your Chase account and Cash App. Whether you’re looking for a quick and easy way to send funds or a more secure option for larger amounts, there’s something out there for everyone.

If you’re looking for a more traditional option, you could also consider using a check. Writing a check is one of the oldest methods of transferring funds, and it’s still used today. All you need is the recipient’s name and address along with your bank account information. Checks are typically sent through the mail and can take several days to process. However, they’re a reliable way to transfer money between Chase and Cash App.