Ordering a chase debit card (complete 2023 guide)

Are you thinking of ordering a chase debit card? If the answer is yes, then you’ve come to the right place! Keeping track of your bank account information is important and sometimes it can be hard to prioritise what type of card to use or not.

Most banks offer various Bank Debit Cards that make life easier by enabling users to access their funds quickly from any corner of the world. Chase Bank is one such institution that provides numerous benefits to customers in terms of banking convenience. From cool features like Chase direct deposit and convenient access to your Chase accounts using an app, the Debit Card it issues comes with a variety of features which are exceptionally helpful for completing day-to-day transactions without cash.

This article will give you an insight into Chase Debit Card and provide you with information regarding its features, benefits, drawbacks and also guide you on how to get started with ordering a Chase Debit Card in 2023. It’s an in-depth guide with everything one needs to know before they take the plunge!

Overview of Debit Cards

Debit cards are a convenient and secure way to make payments. They allow you to access funds in your bank account and use them directly, without having to carry cash or process a check. Chase debit cards offer several benefits, such as the ability to earn rewards points and access money from over 24,000 ATM locations worldwide.

With a Chase debit card, you can also set up direct deposits for paychecks and other income sources, manage your spending with alerts and controls, and even use it as an overdraft protection option if needed. Plus, you can link your debit card to Apple Pay or Google Pay for fast and secure transactions.

Why Choose a Chase Debit Card?

Chase debit cards provide a secure and convenient way to access your funds. Plus, they come with several additional features that make using them even more beneficial.

With a Chase debit card, you can easily earn rewards points when you use it for purchases, get free access to over 24,000 ATM locations worldwide, set up direct deposits for paychecks and other income sources, and manage your spending with alerts and controls. You can also link your debit card to Apple Pay or Google Pay for fast and secure transactions. And if needed, it can also be used as an overdraft protection option. All these features make choosing Chase a great choice when selecting a debit card provider.

How to Order a Chase Debit Card

Ordering a Chase debit card is easy and convenient. First, you’ll need to open a checking account with Chase. You can do this online or by visiting your local branch. Once your account is open and ready to go, you can apply for your debit card.

To do this, visit the website for the product you want and follow the instructions to fill out the application form. In most cases, you’ll be required to provide personal information such as your name and address as well as other details such as your Social Security number and date of birth. You may also be asked to provide employment information or financial statements depending on the type of card you’re applying for. Once submitted, it typically takes around 10-14 days for the card to arrive in the mail. After that, just activate it following the instructions provided and start using it right away!

Step 1: Research and Compare Available Options

Before you can order a Chase debit card, it’s important to research and compare available options. There are various types of cards available, so it’s important to consider the features and fees associated with each one. For example, some cards offer cashback rewards, while others may provide access to exclusive discounts or other benefits. You should also look into the daily limits for withdrawals and purchases as well as any additional fees that may apply such as an annual fee. By doing your research ahead of time, you’ll be better equipped to make an informed decision when it comes time to order your card.

Step 2: Gather Necessary Documentation

Before you can order a Chase debit card, you’ll need to gather the necessary documentation. This includes a valid form of identification such as a driver’s licence, state ID, or passport. You may also need to provide additional information such as your Social Security number and proof of address if they are requested. Additionally, if you’re applying for a joint account, both parties will need to provide their respective documents. Once all the required documents have been submitted and verified, your application will be processed and you can move on to Step 3.

Step 3: Complete the Application Process Online or In-Person

Once all the necessary documents have been gathered, applicants can complete the application process online or in-person. To apply online, simply visit Chase’s website and select the “Debit Card” option from their homepage. Fill out the required information on their secure website and submit your application. Alternatively, you can apply for a Chase debit card in person at any of their physical locations by providing your documentation to an associate. Once your application is approved and you receive your new debit card, you will be able to make purchases anywhere Visa is accepted.

Step 4: Activate and Set Up Your New Debit Card

Once your application has been approved and you receive your new Chase debit card in the mail, it is time to activate and set up your new account. To begin, visit the Chase website or call the customer service number on the back of your card to activate it.

After activation, you can create a username and password to access all of your banking information online. You can then link any existing bank accounts to your debit card and set up direct deposits as well as transfers from one account to another. It’s also important to register any additional cards that may be associated with this account so they are connected and can be monitored easily. Once these steps are completed, you will be ready to start using your new Chase Debit Card!

Benefits of Owning a Chase Debit Card

Owning a Chase Debit Card can be incredibly beneficial for those who want to make purchases without the hassle of carrying cash or writing checks. With this card, you have access to your checking account funds 24/7, which means you can make payments and purchase items whenever you need to. Additionally, it’s easy to track your spending since all activity is logged in real-time on your bank statement.

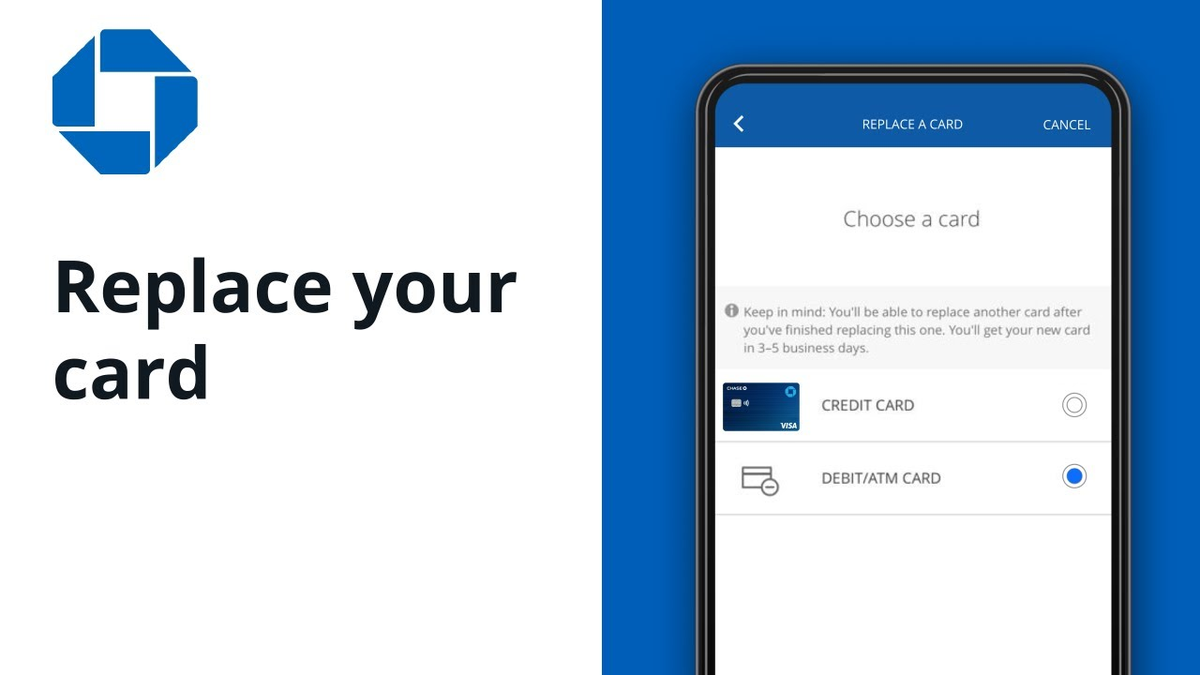

Plus, if your card is ever lost or stolen, you will be able to report it quickly and receive a replacement within days. You also benefit from fraud protection that helps keep your money secure at all times. Finally, with rewards programs and special offers available through Chase Debit Card, you can earn cashback or other discounts while you shop.

A Chase debit card offers a variety of benefits and advantages. With the debit card, Chase customers can access ATMs and make secure cash withdrawals, make purchases in stores or online, receive rewards points for using the card and track real-time account information wherever they are. Additionally, thie debit card has a number of fraud protection features such as chip technology, which provides added security against counterfeit fraud when using the card at retailers who accept chip cards. All this combined makes it easier to manage your money safely and conveniently.

Bottom Line

Ordering a Chase debit card is a process that enables consumers to more conveniently access their account funds for purchases and withdrawals at ATMs. To request a Chase debit card, customers must first open a checking account with Chase. After opening the account, customers can then log into their online banking profile and follow a few simple steps to order the card. Customers can also choose from special designs to customize their cards. The entire process generally takes up to two weeks for the card to arrive by mail.

Ordering a Chase Debit Card is an easy process that can be done in just a few steps.

1. Go to the Chase website and sign up for a personal checking account.

2. Follow the prompts to enroll in your chosen account and make sure to provide all of the required personal information during the application process.

3. Once you have been approved, you will receive an email confirmation which will include your debit card number and details on how to activate it.

4. When your debit card arrives, activate it by calling or visiting your local Chase branch. You may be asked to provide further identification before you can use it.

5. To use your debit card, simply enter your PIN into any ATM machine or POS terminal that supports Chase networks such as STAR®, PLUS®, or Pulse® systems.

6. After successful authorization, funds from your checking account will be transferred and available for use immediately after purchase or withdrawal transaction with no additional fees or charges incurred!